The Dubai residential market continued its upward trajectory, with the Residential Market Sales Price Index reported by REIDIN rising by 15.60% year-on-year. Apartment prices registered a 15.22% annual increase, while villa prices rose by 17.81%. “This sustained increase has been fueled by strong demand from a diverse buyer base, including investors, end-users, particularly first-time homeowners,” commented experts from Cavendish Maxwell, adding that growth has also been supported by developer-led incentives and ongoing government initiatives, both of which have helped strengthen buyer confidence.

Dubai’s real estate sector recorded a total of 2.78 million procedures in 2024, the highest in its history. The record number of methods, which include both real estate transactions and rental agreements, represents a 17 % increase compared to 2023. Real estate transactions alone totalled 226,000, with a combined value of AED 761 billion, a remarkable 36 % growth in volume and 20 % growth in value year-on-year.

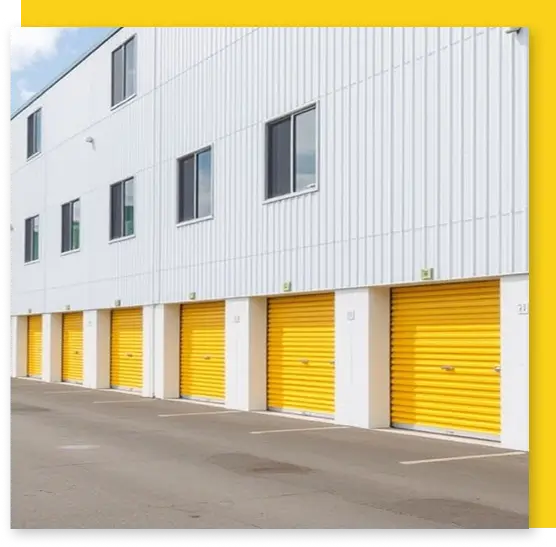

But growth in real estate creates a less glamorous problem: limited space at home. Families shifting from apartments to villas, investors staging properties, and expats relocating all face a common issue — where to keep belongings during transitions. That’s where self storage in Dubai has quietly become an essential service.

The Shifting Landscape of Dubai Real Estate

Luxury Apartments and Downsizing

Dubai has become a magnet for professionals, retirees, and entrepreneurs. Many are choosing smaller, high-end apartments in prime areas like Dubai Marina or Business Bay. While these residences deliver lifestyle and convenience, they often sacrifice storage space. Seasonal items, business inventory, or even sentimental furniture can quickly overwhelm compact living areas.

Villa Expansion and Renovations

At the same time, Dubai is witnessing a villa construction boom. Nearly 9,000 new villas were completed in 2024, with another 19,700 scheduled for 2025. Families moving into these villas often renovate, upgrade, or redesign interiors. During these projects, self storage provides a safe haven for furniture, artwork, and electronics until homes are move-in ready.

Real Estate Transactions at Record Levels

In H1 2025, more than 125,000 real estate deals were recorded — a 25% increase compared to the same period in 2024. With every sale, purchase, or rental, there’s a transition phase. Self storage offers the breathing space residents need while waiting for keys, preparing for handover, or relocating across communities.

The New Face of Luxury Living—And Why Storage Sits in the Middle

Dubai’s real estate trends are moving in two directions at once: sleek, luxury apartments in Dubai (Downtown, Dubai Marina, Business Bay, JLT) keep rising in popularity, while villas in Dubai (Palm Jumeirah, Arabian Ranches, JVC) pull families toward space, privacy, and outdoor living. Whether residents downsize into high-rise apartments or upsize into villas, one constant emerges—demand for self storage in Dubai.

Market Growth and Potential

The UAE self storage market generated USD 602.5 million in 2024 and is expected to reach USD 859.2 million by 2030, growing at a 6.3% CAGR. Dubai leads this growth, not only due to its population nearing 4 million but also because of the unique lifestyle of its residents — globally mobile, affluent, and constantly on the move.

Why Demand Is Growing

- Expat Lifestyle: Many residents come for short to medium-term work contracts. Instead of selling belongings when relocating, they prefer storage solutions.

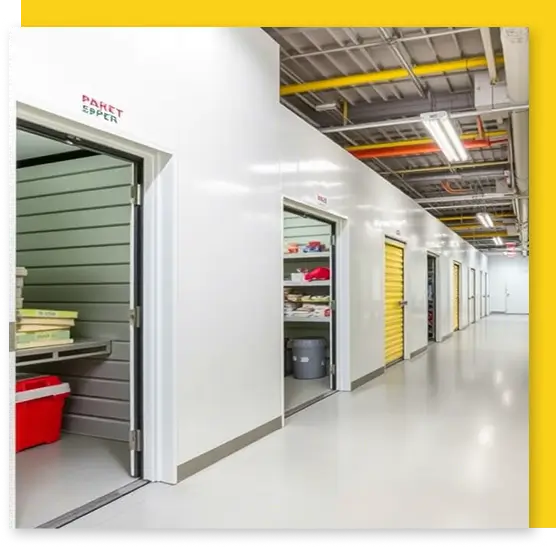

- Luxury Expectations: Residents who invest in high-end properties expect self storage to match — climate-controlled units, 24/7 security, and digital access.

- Business and E-commerce: Startups and SMEs increasingly use self storage as flexible warehousing, especially in prime areas where commercial rent is high.

A Fast Market Needs Fast, Flexible Space

Where do the extra belongings, boxes, and bulk decor go while a property is prepped? That pressure lands squarely on self storage in Dubai. As real estate trends in Dubai accelerate—flips, resales, and short-term rentals—investor storage UAE has become the flexible backbone that makes professional staging possible.

Why Staging Works in Dubai’s Real Estate Cycle

- Speed to offer: Neutral, well-lit rooms help buyers imagine themselves in the home, shortening days on market.

- Higher perceived value: A curated layout directs attention to views, floor plan, and finishes—especially vital in premium towers and villas.

- Consistency across portfolios: Investors managing multiple units need a repeatable, brandable interior look. Real estate storage Dubai enables that consistency without cramming units with spare furniture.

Bottom line: Staging converts attention into offers. Temporary storage Dubai converts clutter into clean sightlines—without forcing fire-sale giveaways of usable furniture.

Apartment vs. Villa: Staging Patterns and Storage Tactics

- Luxury apartments (Downtown, Marina, Business Bay, JLT): Smaller footprints mean minimalism sells. Use temporary storage in Dubai to remove bulky cabinets, sectional sofas, and oversized art; bring in compact staging sets that emphasize circulation and views.

- Villas (Palm Jumeirah, Arabian Ranches, Jumeirah Park, Damac Hills): Focus on proportion and lifestyle. Garage clutter, outdoor furniture, and seasonal décor move to real estate storage Dubai, so landscaping, pool zones, and family rooms feel expansive and aspirational.

The Staging Workflow (And Where Storage Slots In)

- Pre-audit (Day 0–3): Inventory every room. Tag what stays for staging and what goes to short-term storage in Dubai.

- Pack & remove (Day 3–6): Use breathable covers and crate glass/stone. Photograph cable setups for later reinstall.

- Minor works & deep clean (Day 6–10): With pathways clear, trades finish faster; dust doesn’t embed in fabrics kept off-site.

- Staging install (Day 10–12): Bring in the curated set from investor storage UAE—two accent pieces per zone, no duplicates.

- Photography & viewings (Day 12+): Keep surplus in self storage in Dubai until offer/transfer. Then reintroduce or redeploy items to the next listing.

When Real Estate Trends Create Hospitality Opportunities

Real estate trends in Dubai have a ripple effect: more units entering the market for holiday homes and Airbnb. With that growth, hosts face a practical challenge—where to put everything that doesn’t belong in today’s guest-ready photos. That’s why self storage in Dubai has become a core back-of-house tool for hosts.

More People, More Property Moves—More Storage

Dubai’s population keeps rising, and each new resident sets off a chain reaction: more rentals, more purchases, more renovations, and more relocations. These real estate trends in Dubai don’t just shape skylines; they influence how people manage belongings day to day. As apartments and villas fill up, self storage in Dubai becomes the flexible “buffer space” that absorbs the overflow—between handovers, during refurbishments, and whenever life outgrows floor plans.

From Population Growth to Property Pressure

Dubai population growth storage demand expands for three connected reasons:

Household formation

New arrivals form new households. That means new leases and purchases, and—crucially—timing gaps between move-out and move-in. Temporary storage in Dubai bridges those gaps without forcing rushed decisions.

Smaller, smarter footprints

In central districts, luxury apartments in Dubai focus on amenities and location, not large storage rooms. Residents shift excess wardrobes, luggage, and hobby gear into personal storage in Dubai, keeping high-rise living uncluttered.

Upgrade and renovation cycles

Families moving into villas in Dubai often upgrade kitchens, flooring, and landscaping. While contractors work, villa storage Dubai protects furniture, electronics, and art. The more people arrive, the more these cycles repeat—raising UAE storage demand.

Takeaway: Population growth intensifies transactions and projects. That’s the engine behind real estate and storage in Dubai, moving in tandem.

How Real Estate Trends Convert Into Storage Needs

- High transaction velocity → short-term storage: When keys change hands quickly, sellers and buyers need a neutral, secure place for belongings.

- Downtown/Marina density → second-closet effect: Compact layouts heighten demand for climate-controlled storage for garments, leather goods, instruments, and tech.

- Suburban villa wave → project staging: Renovations, staging for resale, and seasonal living push bulky items into furniture storage for weeks or months.

- Hybrid work & micro-commerce → mini-warehouse units: Side hustles and small e-commerce brands use units near JLT/Business Bay/Al Quoz, tying real estate and storage in Dubai to entrepreneurship.

Dubai Real Estate Market and Its Impact on Self Storage

Dubai’s property sector is one of the fastest-growing in the world, with record-breaking deals, surging prices, and continuous new developments. These numbers don’t just highlight investor confidence—they also underline the practical challenges residents face when moving, downsizing, or upgrading their homes. Each new sale, renovation, or relocation creates demand for self storage in Dubai, turning storage into an essential part of the property cycle.

| Metric | Value | Impact on Storage Demand |

|---|---|---|

Property price growth (3 years) | ~60% increase | More relocations, upgrades, and staging needs |

Avg. cost per sq. ft. (2025) | AED 1,750 (USD 476.5) | Compact living spaces → higher self storage use |

Real estate transaction volume 2024 | AED 761 billion (USD 207B) | Increased sales → more temporary storage required |

Deals recorded H1 2025 | 125,000+ (26% YoY growth) | Faster turnover → storage bridges handover and transition gaps |

New villas completed in 2024 | ~9,000 units | Renovation & fit-outs → spike in villa storage Dubai |

Upcoming villas for 2025 | ~19,700 units | More families relocating → growth in long-term storage needs |

Population (2025 projection) | ~4 million | Larger households → higher UAE storage demand |

Neighborhood Micro-Patterns (Population → Property → Storage)

- Downtown, Business Bay: Frequent tenant turnover and investor activity; strong temporary storage Dubai usage for staging and swift handovers.

- Dubai Marina, JBR, JLT: Young professionals in compact apartments; personal storage in Dubai for sports gear, travel boxes, and seasonal decor.

- Palm Jumeirah, Arabian Ranches, JVC: Family growth and villa upgrades; villa storage Dubai for furniture and outdoor sets during fit-outs.

- Al Quoz, Barsha South: Proximity to courier and logistics corridors; SMEs adopt mini-warehouse units to avoid long leases.

Who’s Driving UAE Storage Demand?

- New expat arrivals: Arrive with full households; park excess in self storage in Dubai until long-term homes are finalized.

- Inter-emirate movers: Job and school changes push families to relocate; temporary storage in Dubai smooths transitions.

- Seasonal residents: Split time between countries; use climate-controlled storage for art, wardrobes, and electronics during absences.

- SMEs & creators: Inventory, props, documents—real estate and storage in Dubai intersect where small businesses keep costs flexible.

Practical Guide: Matching Population-Driven Scenarios to Storage

Scenario A — New lease overlap: Use temporary storage in Dubai for 2–6 weeks; prioritize a 50–75 sq ft unit for boxes + two large pieces of furniture.

Scenario B — Apartment space squeeze: Go “second closet”: 25–35 sq ft climate-controlled storage for seasonal wardrobes, luggage, and hobby gear.

Scenario C — Villa fit-out: Choose 100–150+ sq ft villa storage in Dubai; request padded transport, breathable covers, and desiccants.

Scenario D — SME side hustle: Pick a drive-up unit near logistics routes; add shelves and clear bin labels to run a micro-warehouse.

Real Estate Momentum → Storage Momentum

Dubai’s real estate sector kicked off 2025 with remarkable momentum. Developers launched over 30,000 new residential units in Q1 2025 alone, more than double the volume from the same period last year. Plans indicate ~210,000 new units by 2026, which means more move-ins/outs, fit-outs, staging, and short gaps between keys changing hands. Those pressures are exactly what push self storage in Dubai from “optional” to essential infrastructure. Looking toward 2030, the future of storage Dubai will mirror these housing cycles: faster, smarter, greener, and more premium—supporting a market forecast often cited near USD 859.2M by 2030.

How Housing Supply Becomes Storage Demand

Dubai real estate storage dynamics are simple: every new home creates a storage moment.

- Handover gaps: Sellers vacate before buyers can move—temporary storage in Dubai bridges the timing.

- Renovations & fit-outs: Kitchens, wardrobes, flooring → belongings decant to villa storage Dubai or apartment units.

- Staging & resales: Investors declutter into investor storage UAE so listings photograph and show better.

- Compact urban living: Central towers optimize amenities over storerooms → “second-closet” climate-controlled storage.

In short, Dubai real estate storage will not be an accessory—it will be an integral step in every property journey.

Takeaway: Real estate and storage in Dubai move in lockstep; bigger housing cycles mean bigger storage cycles.

UAE Storage Ttrends

Looking forward, UAE storage trends reflect the same diversity as Dubai’s housing supply. Apartments, villas, and mixed-use communities create different use cases.

- Flexibility above all: With project timelines shifting, residents will increasingly demand month-to-month storage contracts instead of annual commitments.

- Micro-warehousing for SMEs: E-commerce and creators rely on units near Al Quoz, Business Bay, JLT, treating storage as affordable distribution hubs.

- Category specialization: The market will split into niches—wardrobe vaults, fine art rooms, document archives, and climate-controlled car bays.

- Geographic clustering: Operators will expand footprints near population clusters (Marina, JVC) and villa belts (Arabian Ranches, Palm, Barsha South) to reduce commute and delivery times.

Takeaway: The future of storage in Dubai will be shaped by residents who want convenience, investors who need flexibility, and businesses looking for cost-effective alternatives to long-term leases.

Tech Adoption: Smarter, Faster, Frictionless

The future of self storage in Dubai won’t be about padlocks and paper forms—it will feel more like logging into an app.

- Smart locks & app-based access: Digital keys with time-limited sharing allow family, staff, or movers to enter securely without physical handovers.

- Inventory visualization: Photo-based or even AI-tagged inventories will let tenants “see” their stored boxes and request specific items for delivery.

- Integrated logistics: Storage facilities will sync with courier platforms, enabling direct deliveries from a unit to customers or suppliers—perfect for investor storage UAE and SMEs.

- Automation & robotics: In business units, robotic retrieval systems will make bulk stock management faster and reduce labor costs.

Premiumization: Storage That Matches Dubai Living

Dubai’s upscale housing mix powers premium UAE storage trends:

- Climate-controlled storage tiers: humidity-stable rooms for leather, wood, instruments, and AV.

- White-glove services: Packing/crating, insured transport, photo-logged intake/outtake.

- Wardrobe concierge: Seasonal rotation, garment steaming, and delivery on request.

- Vehicle & toy storage: Climate-protected bays for classic cars, bikes, watersports gear—popular with Palm and Ranches residents.

Sustainability: Efficient by Design

Sustainability isn’t just a global trend—it’s part of Dubai’s development blueprint. That extends into UAE storage trends.

- Solar-powered facilities: Rooftop panels and battery systems will offset cooling costs while keeping units energy efficient.

- Smart HVAC & ventilation: Climate control will balance stable temperatures with reduced emissions.

- LED lighting with sensors: Power consumption will shrink as lighting adapts to occupancy.

- Reusable crates & recycled packing: More operators will replace single-use plastics with durable, eco-friendly alternatives.

By 2030, real estate and storage in Dubai will reflect the same sustainability goals as Expo legacy projects and smart communities.

Neighborhood Outlook: Where Demand Concentrates

Different property trends fuel different storage patterns.

- Downtown & Business Bay: High transaction velocity—expect strong demand for temporary storage in Dubai during frequent handovers.

- Dubai Marina & JBR & JLT: Young professionals in compact apartments—climate-controlled storage for wardrobes, sports equipment, and personal gear.

- Palm Jumeirah, Arabian Ranches, JVC: Villa residents upgrading or redesigning—villa storage Dubai for furniture, art, and outdoor sets.

- Al Quoz, Barsha South: Logistics corridors where SMEs and investors operate—investor storage UAE and micro-warehousing solutions.

Each cluster proves the same point: real estate trends in Dubai directly dictate where storage grows next.

Resident & Investor Checklist (Future-Proof Your Storage)

Choose climate control: For wood, leather, textiles, instruments, and electronics.

Right-size it:

- 25–35 sq ft → wardrobes, décor, 10–15 boxes

- 50–75 sq ft → 1-bed set + boxes

- 100–150+ sq ft → villa rooms, outdoor sets, appliances

Location > minutes saved: Keep your unit within a 10–15-minute radius of your building/community.

Ask for proof: CCTV logs, access controls, insurance options, photo-logged intake.

Think rotations: Use a quarterly schedule to swap seasonal items and keep homes uncluttered.

Conclusion: Real Estate and Self Storage Go Hand in Hand

Dubai’s rapid real estate growth has created more than just new skylines—it has reshaped how people live, move, and manage space. Whether it’s the shift toward sleek, luxury apartments in Dubai, the boom in villa storage in Dubai during renovations, or the fast pace of record-breaking property transactions, one pattern is undeniable. Every property milestone sparks a demand for self storage in Dubai.

For expats balancing mobility, families expanding into new communities, or investors staging properties, storage has become the invisible bridge that makes transitions seamless. The surge in UAE storage demand—expected to reach USD 859.2M by 2030—is proof that storage is no longer an optional add-on; it is a cornerstone of modern urban living.

In the years ahead, as Dubai real estate trends deliver thousands of new homes, self storage will continue to evolve—smarter, greener, and more premium—to match the lifestyle of the city’s globally mobile residents. Simply put, real estate builds the homes, but storage makes them livable.

Frequently Asked Questions (FAQs): Real Estate Trends and Self Storage in Dubai

Frequently Asked Questions (FAQs): Real Estate Trends and Self Storage in Dubai

Because rapid property transactions, relocations, and renovations create timing gaps and space shortages, self storage in Dubai solves these challenges.

Who uses self storage in Dubai the most?

Expats, families moving into new villas, investors staging properties, and SMEs needing flexible warehousing all drive UAE storage demand.

How does downsizing into luxury apartments affect storage needs?

Smaller footprints in prime districts like Marina or Business Bay push residents to use personal storage in Dubai for wardrobes, decor, and sports gear.

What role does villa construction play in storage demand?

With thousands of new villas delivered annually, families renovating or upgrading rely on villa storage Dubai to protect furniture and electronics.

Is climate-controlled storage necessary in Dubai?

Yes. Dubai’s heat and humidity make climate-controlled storage essential for clothing, wood furniture, electronics, and art.

How does self storage help real estate investors?

During staging, investors use real estate storage in Dubai to remove personal items and store surplus décor, making properties more appealing to buyers.

Can self storage benefit Airbnb and holiday rental hosts?

Absolutely. Hosts use short-term storage in Dubai for linens, seasonal décor, and furniture rotation, keeping rentals uncluttered and guest-ready.

What are the average costs of storage in Dubai?

Units start around AED 300 per month, with prices varying by size, location, and whether climate-controlled storage is included.

How big a unit do most residents need?

25–35 sq ft → wardrobes, boxes, décor

50–75 sq ft → 1-bedroom apartment contents

100–150+ sq ft → villa rooms, outdoor furniture, appliances

What is the future of storage in Dubai by 2030?

The future of storage in Dubai will be smarter, greener, and more premium—with app-based access, sustainable facilities, and a market size forecast of USD 859.2M by 2030.